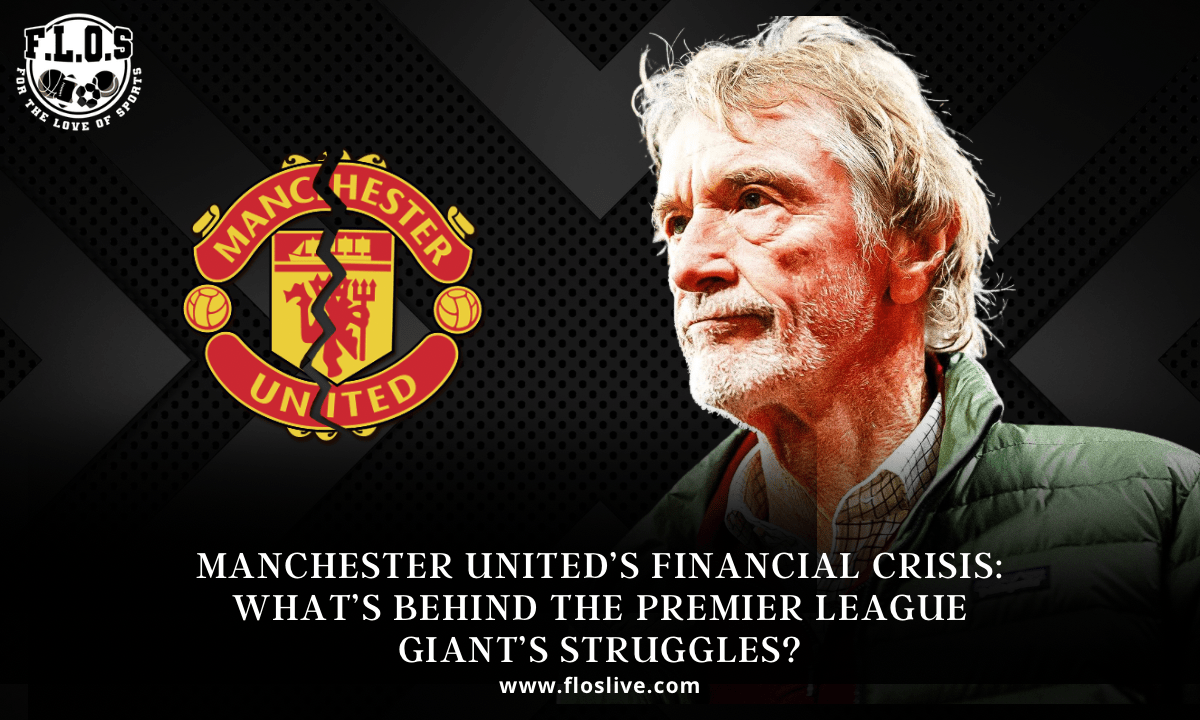

“How the mighty have fallen” was the sentiment echoed by many when Manchester United’s hierarchy reached out to supporters, urging their cooperation as the club faced what was described as a looming financial crisis toward the end of 2024.

The club reported a staggering loss of over £312.9 million over the past three years, putting them at significant risk of breaching the Premier League’s Profitability and Sustainability Regulations (PSR).

While the Red Devils are not under immediate threat of sanctions from the league authorities, several measures have already been implemented by the INEOS group, led by Sir Jim Ratcliffe, to prevent the crisis from deepening in future financial years.

According to The Guardian, these austerity measures include increasing matchday ticket prices to £66 with no discounts for seniors or children, raising parking fees for disabled fans, and scrapping the £50 “steward of the match” award.

There have also been suggestions that United may look to offload some of their brightest homegrown talents—such as Alejandro Garnacho and Kobbie Mainoo—as a way to ease the growing financial strain.

But how did it come to this? Just over a decade ago, Manchester United was one of football’s highest-earning institutions, admired for its financial strength and management. Now, the club finds itself in turmoil. How did an impeccably run football powerhouse become a financial circus?

In this article, we delve into the key factors behind Manchester United’s financial struggles.

Reasons behind Manchester United’s financial struggles

Recruitment strategy

One of the biggest factors behind Manchester United’s financial struggles is their approach to player recruitment—an issue that has become deeply ingrained in recent years.

Since the departure of Sir Alex Ferguson and former CEO David Gill in 2013, United have spent approximately £2.1 billion on player signings. While this places them among the highest spenders in world football during that period, the real problem lies in the quality of these acquisitions. Despite their relentless transfer activity, the club has consistently failed to bring in players who deliver the expected impact. Simply put, while United’s spending ranks at the top end of the Premier League, the return on investment has been far less impressive.

Additionally, the financial burden of these transfers has been exacerbated by the club’s reliance on installment-based payment structures. Like many clubs, United have signed players on credit, with agreements to spread transfer fees over multiple years. As a result, according to their most recent financial reports, they owe £414 million in outstanding transfer payments—second only to Chelsea. This has created a fiscal drag, as existing financial commitments to past signings have taken precedence over new acquisitions.

Compounding the issue is United’s inefficiency in selling players. The club’s ability to generate funds from outgoing transfers has been just as poor as their form on the pitch during the 2024-25 season. According to data from Football Transfers, for every £100 Chelsea have made in player-sale profits since Ferguson’s retirement, United have earned just £20. To put that into perspective, Chelsea have recouped approximately €1.2 billion from player sales, while United have generated only around €470 million.

It’s worth noting that player-sale profits contribute to Profitability and Sustainability Regulations (PSR) calculations, and in this regard, United rank as the weakest performers among the so-called “Big Six” clubs in England.

Endless overhead spending

Since Sir Jim Ratcliffe’s takeover, several high-cost decisions have further compounded Manchester United’s financial struggles.

Among them is the multimillion-pound release fee paid to Newcastle for high-profile Sporting Director Dan Ashworth, only for United to sack him five months later. Then came the decision to trigger Erik ten Hag’s contract extension, only to dismiss him and his staff shortly after, costing the club a hefty £10.4 million. Adding to the expenses, United paid Sporting CP £11 million in compensation for Ruben Amorim and his coaching team. These decisions, along with nearly £250 million spent on player transfers, have left the club languishing in 14th place in the Premier League.

However, the financial strain at Manchester United isn’t solely down to INEOS. The Glazers have also played a significant role in the club’s mounting losses. When they took over in 2005, they used a leveraged buyout, essentially financing the acquisition through loans and burdening the club with the resulting debt. Before their takeover, United was one of the few debt-free clubs in Europe, but their ownership left the club saddled with hundreds of millions in liabilities—an amount that has only worsened over time.

Rather than alleviating the financial strain, the Glazers have continued to withdraw hundreds of millions in dividends while contributing little to the club’s improvement. This neglect has led to the neglect and deterioration of key facilities, including Old Trafford’s roof, which has become infamous for leaking during rain-affected fixtures.

In the club’s 2024 accounts, £34.6 million was recorded under “costs related to strategic review and share sale agreement with Trawlers Limited”—the company through which Ratcliffe acquired his stake. Essentially, while the Glazers made hundreds of millions from selling shares, United were left to absorb the financial burden.

The club’s accounts also reveal operating expenses of just under £340 million in each of the past two years, with “other operating expenses” covering catering, policing, stewarding, cleaning, and visitor gate shares for domestic cup competitions.

When these expenses are combined with the club’s enormous wage bill—£364.7 million in the 2023-24 season—even United’s massive revenues of £661.8 million for the same period still resulted in a financial loss. All this prior to accounting for additional minor operational costs and the £20 million paid annually to service the debt imposed by the Glazers’ when they purchased the club in 2005.

Future Outlook

Manchester United find themselves in a precarious financial position, making it crucial for the club to take deliberate steps toward stabilization. However, there is some positive news for fans—United continue to generate substantial cash from their day-to-day operations. Additionally, while the recent staff redundancies imposed by INEOS may seem drastic and arguably unjustified, they could play a role in helping the club recover financially.

In a recent interview, INEOS CEO Sir Jim Ratcliffe revealed that Manchester United are planning to build a new stadium in a project set to cost around £2 billion, which would surpass the current Old Trafford in size and expand its capacity to a staggering 100,000 seats.

From an economic standpoint, this development is expected to significantly boost stadium-related revenue. At present, United generate an estimated £5 million per home match. However, with the proposed new stadium, matchday income is expected to double and potentially drive financial growth across various revenue streams.

Nevertheless, while the club’s administrative team continues to strategize ways to salvage its finances, one undeniable truth remains: success on the pitch directly impacts financial stability. If United can rediscover their winning formula and deliver strong performances, the resulting revenue boost—similar to the club’s golden years under Sir Alex Ferguson—could go a long way in restoring their financial health.

Must See

-

Football

/ 2 months agoFLOS 2025/2026 Premier League Season Predictions

The wait is almost over. The 2025/26 Premier League campaign kicks off when Liverpool...

By Samson Osaze -

Basketball

/ 4 months agoOKC’s Title Triumph: The Birth of a Dynasty?

The Oklahoma City Thunder are your 2024–25 NBA champions. That sentence hasn’t just felt...

By Samson Osaze -

Other Sports

/ 6 months agoGOAT Debate: McIlroy’s Place in Golf History After Career Slam Win

Rory McIlroy’s historic win at the 2025 Masters Tournament has cemented his place among...

-

Flos Live

/ 7 months agoSerie A Title Race: Who Will Lift the Scudetto?

Thirty games played, two historic clubs battling for glory, and two iconic managers leading...

By Samson Osaze